February 2021

On November 3rd, Californians voted by a slim margin to pass Proposition 19, the Home Protection for Seniors, Severely Disabled, Families, and Victims of Wildfire and Natural Disasters Act (“Prop 19”). Prop 19 changes property tax benefits for all people who stand to inherit real property in California from their parents (or grandparents) as well as certain individuals looking to buy a new home. As with all new tax measures, Prop 19 has generated a fair number of questions. We here at FLAS have answered some of the more common questions about Prop 19 below:

How does Prop 19 affect California real property passed between parents and children?

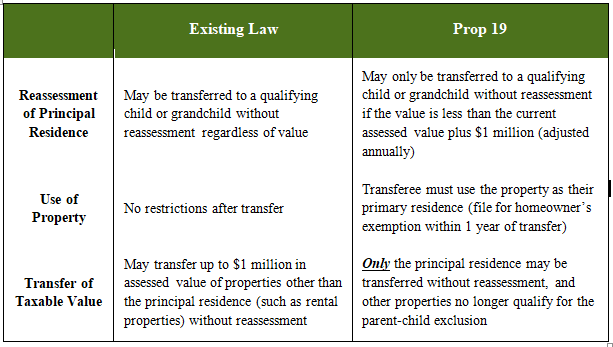

The basis for all real property taxation in California is the fair market value at the time of the last “change in ownership” of the property. Each change in ownership creates an opportunity for tax authorities to “reassess” the fair market value of a property at the time of the change and, assuming rising property values, increase the amount of property tax assessed. Existing laws have created a large tax incentive for parents (or qualifying grandparents) to pass property to the younger generation, by declaring these inter-generational transfers are not a change in ownership for purposes of reassessing fair market value. Prop 19 significantly changes the scope of the parent-child exclusion by implementing new limitations on the value of the property that may be transferred and which transfers qualify to receive this tax benefit. These changes are detailed below:

The principal limitation that Prop 19 adds to qualifying for a parent-child exclusion for the primary residence is that it requires the qualifying child (or grandchild) inheriting the home to also use it as their primary residence to avoid a property tax reassessment. Under Prop 19, if a child inherits a house from their parents or grandparents and decides to use it as a second home, or to rent out the house instead of living in it, the house will be subject to reassessment.

The other main change to the parent-child exclusion is that Prop 19 sets a $1 million cap on the value of the primary residence that may be transferred. Under Prop 19, if the inherited home’s current market value is higher than the assessed value of the property plus $1 million, then the increase in value after the first $1 million is added to the new tax assessed value. Here are two scenarios that illustrate this new rule:

Scenario 1: A man is inheriting a home from a qualifying parent or grandparent that he plans on using as his primary residence. The home’s assessed value at the time of the transfer is $1.5 million, and the current market value of the property is $1.8 million. Since the property’s current market value does not exceed the assessed value by more than $1 million, the man will retain his parent’s (or grandparent’s) assessed value for the home.

Scenario 2: A man is inheriting a home from a qualifying parent or grandparent that he plans on using as his primary residence. The home’s assessed value at the time of the transfer is $500,000, and the current market value of the property is $1.8 million. Since the property’s current market value exceeds the assessed value by more than $1 million, the man will not retain his parent’s (or grandparent’s) assessed value for the home. Instead, according to Prop 19, the home’s new assessed value will be $800,000 (the difference between the $1 million cap and the property’s current market value).

When do these new changes to the parent-child exclusion go into effect?

These provisions of Prop 19 go into effect for transfers of real property made on or after February 16th, 2021.

Should I do anything with my property before February 16th to maintain my tax benefits?

If you have a property that you would like your children to inherit, but you do not believe you would meet the requirements for a tax exclusion, there are steps you can take before the new laws become effective. You may consider gifting your principal residence, or if you have rental property, in some instances, transferring the property into a business entity, such as an LLC. Another option may be to put the property you wish to pass on in a trust. Prop 19 does apply to all property held in revocable trusts, but there may be steps you could take to create an irrevocable trust to prevent reassessment. However, there are many nuances and potential downsides to each of these options. For example, the cost basis of property transferred at death can receive a “step-up” in basis to its fair market value, eliminating an heir’s capital gains tax liability on appreciation in the property’s value that occurred during the decedent’s lifetime. Any potential loss of the step-up in basis that the transfer may cause should be weighed against the potential tax savings of avoiding a reassessment by taking advantage of the current parent-child exclusion. This could also be a good opportunity to explore your family’s desires and what potential strategies and wishes they may have about the future of any real property you may own. Speaking with an experienced estate planning attorney is strongly advised. While there may be limited time to accomplish such transfers before February 16th, there may also be opportunities after this date to protect both the step-up in basis and also preserve the tax basis when transferring properties to the next generation. Consultation with a qualified tax advisor or attorney may help to determine the best strategy for you and your family going forward.

How does Prop 19 affect purchasing a new home?

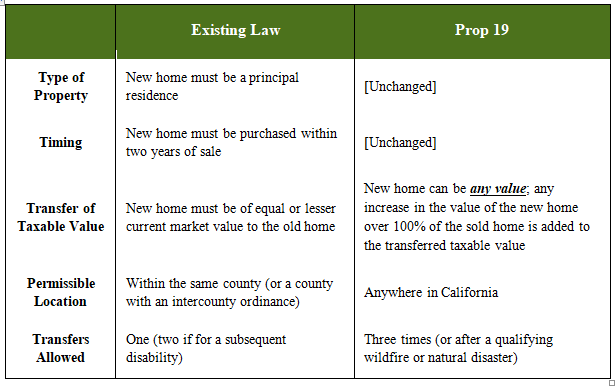

A series of existing laws allowed homeowners who were 55 years of age or older, severely disabled, or victims of a natural disaster to qualify for a large tax break when they purchased a new home if they met a number of requirements. Prop 19 replaces these laws and significantly modifies three of these requirements to loosen these restrictions, with the goal of encouraging more turnover in the housing market. These changes are detailed below:

For example, imagine that a 65-year-old woman, who purchased a home in 1990 for $100,000, is now buying a new home. Her original home is now worth $1,000,000. Under existing law, she would only be able to transfer the $100,000 assessed, taxable value of her original home to the home she wishes to purchase if that new home was worth $1,000,000 or less (with some limited exceptions), and only within certain qualifying counties. Under Prop 19, however, she can transfer her original home’s taxable value to any new home she buys in California, regardless of price or the county where the home is located. If she purchases a new home for $1.1 million, her new taxable value would be $200,000, the sum of her original taxable value ($100,000) plus the $100,000 increase in the difference in the current market values of the two homes. Furthermore, she can now do this up to three times instead of only once.

When do these new laws about home purchases go into effect?

These provisions of Prop 19 go into effect on April 1, 2021.

If the new home is of equal or lesser value, does the taxable value of the new home change?

No. Just like under existing laws, under Prop 19, the original property’s taxable value may be transferred and become the taxable value of the new one.

Can a new home be purchased prior to the original home being sold?

Yes. This is allowed under existing law, and Prop19 uses nearly identical language.

Prop 19 will surely have an impact on California’s housing market for years to come as families reconsider their plans under the new tax rules. The significant changes to the property transfer process within families, in particular, means it is certainly worth revisiting your estate plan and talking with the experienced estate planning attorneys at FLAS to determine the best course of action for you and your family.

Ian L. Midiere, Attorney

Direct: (805) 966-9071

Email: LMidiere@flasllp.com

DISCLAIMER: This publication is one of a series of business, real estate, employment, estate planning and tax bulletins prepared by the attorneys at Fauver, Large, Archbald & Spray, LLP. This Advisor is not exhaustive, nor is it legal advice. You should discuss your particular situation with us or with your own attorney. Our legal representation is only undertaken through a written engagement letter and not by the distribution or use of this publication.